Ifinance 4 4 – Comprehensively Manage Your Personal Finances Skills

Managing Your Personal Finances: 5 Steps to Personal Financial Fitness and Independence Managing your personal finances as a career newbie can be tough especially when you make barely enough. However, with some good managing personal finance habits you should be able to have money saved at the end of the month. Banktivity 7.0 – Intuitive personal finance manager. Banktivity (was iBank) is a new standard for Mac money management. With its intuitive user interface and a full set of money-management features, Banktivity is the most. Identifying the tasks, duties, and responsibilities that make up a job and the knowledge, skills, and abilities needed to perform the job. Lifelong learner. Actively seeking new knowledge, skills, and experiences that will add to your professional and personal growth throughout your life. Managing your personal finances - chapter 2 33 terms.

- Ifinance 4 4 – Comprehensively Manage Your Personal Finances Skills Examples

- Ifinance 4 4 – Comprehensively Manage Your Personal Finances Skills Include

- Ifinance 4 4 – Comprehensively Manage Your Personal Finances Skills Assessment

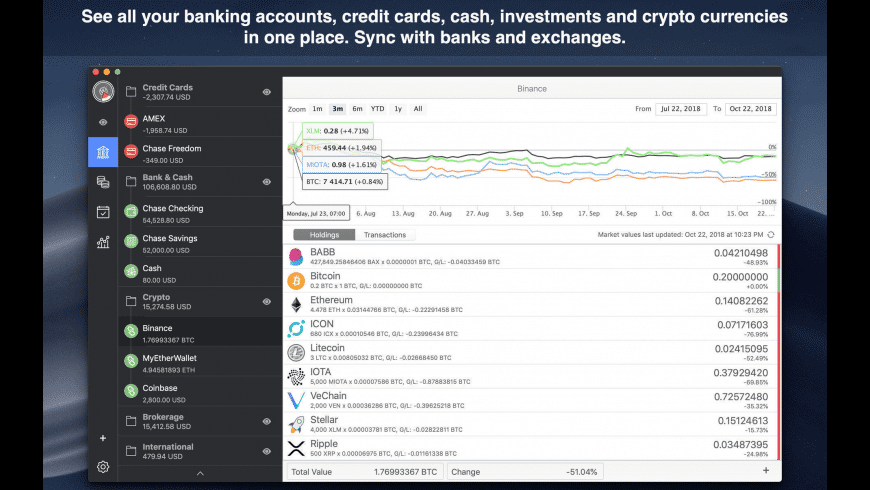

iFinance lets you manage your personal finances like a pro.

With its intuitive new interface, iFinance helps you keep your eyes on all your latest financial data without the confusion of trying to reconcile information from multiple sources. Quickly access to your data along with helpful analytical diagrams; create budgets and monitor your stock portfolio; conveniently manages your entire cash flow across multiple accounts.

iFinance is the comprehensive and efficient way to manage your money -- get it today!

The version 4 public beta is free to use, and will not incur a charge until it is finally released.

Version 4.0 Public Beta 5:

Note: Requires OS X 10.10 or later running on a 64-bit Intel processor.

- New: You may now select to start in the overview section or finance section

- New: Duplicate transactions, splits transactions, reports and charts via cmd+d

- Solved many issues with WiFi sync and improved usability

- Budgets now again show the exceeded amount instead of zero

- Transaction list can now be sorted by reconcile state, check number and title

- Many more improvements and bugfixes

Managing Your Personal Finances : 5 Steps to Personal Financial Fitness and Independence

Managing your personal finances as a career newbie can be tough especially when you make barely enough. However, with some good managing personal finance habits you should be able to have money saved at the end of the month. Hence, allowing that money to be spent on purchasing a car or perhaps a better car or even in the long run a house!

Good habits in managing your personal finances have to start early. If you are a career newbie, start on these habits now and keep to it. To you these advice may seem common or cliché, but I assure you they work. I have personally practiced them as a career newbie and they worked for me. Following these tips so to speak has allowed me to save and do more with my pay and life.

1. Record Your Daily Expenses

I learned this habit of managing your personal finances while I was still in university. I was a foreign student in the United States paying out of state tuition fees. Coupled with the exchange rate, foreign students like myself could not afford to overspend each week. This practice stayed with me well into my early career life.

When I graduated and came home, I left my hometown for the big city. Again, as a city dweller from a small town I needed to save all I could in order to pay rent, transportation and all. By recording my daily expenses, I was able to know if I was spending too much on certain items that may not be necessary at that time. If you do this, you would be surprised at the amount of things you can cut out.

2. Pay Yourself First!

This concept is my favorite and is my personal wealth secret. This technique of managing your personal finances is simple. It means what it says – pay yourself first! This is what you do. When you first get your paycheck, do not do anything with it until you have taken some for the purpose of saving for yourself. What people typically do when they receive their paycheck is to pay off bills first.

In this case, you take out a portion you are comfortable with and put them away in another account. Inevitably, you will find that at the end of the month you will still be able to pay the bills with money saved for yourself. Try this, it is fun to see how you will naturally self-adjust your spending when you have saved some money aside.

3. Avoid Credit Cards

I should say avoid credit cards if you do not have very good self-discipline. I am proud to say that I have never got into credit card debts. Credit cards are wonderful things and with all wonderful things they can sometimes be prone to abuse.

If you have a tendency to delay your credit card payments and buy on impulse even when your finances cannot support it then avoid credit cards. Credit cards are there to provide a convenience. Not to sustain a lifestyle you cannot afford. Managing personal finances takes great discipline. Avoid credit cards if you have a problem controlling spending.

4. The Two Week Rule

You probably know this as delayed gratification. I used to spend a lot of time window-shopping as my office was within the shopping district. Inevitably, I ended up buying things that was not necessary. It could be a new shirt or a new gadget.

Money that could be saved, I spent. I was lucky to realize this fast enough – via my daily financial records – items that I was spending unnecessarily on. I created a two-week rule for myself. Each time I wanted to buy something on impulse I walked away. I tell myself that if in two-weeks I still want it bad enough I would then return to buy it. Often times, by two weeks I would have forgotten how much I wanted that item!

5. Shop with A List

Related to the above in managing your personal finances is shop with a list. This again requires self-discipline. When you shop with a list you avoid buying the unnecessary on impulse. These impulsive purchases have a tendency to eat into your savings or what you could have easily saved.

Managing your personal finances is easy. Yes, it requires a little self-discipline but it can be done. And its returns are well worth it!

Can I recommend this? Invest in a copy of 101 Great Ways to Enhance Your Career. I am a contributing author together with the world's 100 other career experts. It will help you answer a lot of career questions you have and make a great gift for yourself or your colleague. Check it out here.

| More Articles About Financial Planning |

Secrets To Successful Investing – A Newbie’s Guide

As you begin to collect your first paycheck you may want to start to save and even start thinking about investing. Here are 6 basic tips to successful investing.

Keys To Financial Planning – A Newbie Guide to Allocation of Your Hard Earned Money

What are the keys to financial planning a newbie at work should know?

Ifinance 4 4 – Comprehensively Manage Your Personal Finances Skills Examples

Wealth Secret For Career Builder Newbies

You will be looking for your wealth secret shortly after you started work. Let me share with you my wealth secret.

Importance of Financial Planning for Fresh Graduates Starting On Their First Jobs

Ifinance 4 4 – Comprehensively Manage Your Personal Finances Skills Include

The importance of financial planning is a key component you must understand as you begin your career.Ifinance 4 4 – Comprehensively Manage Your Personal Finances Skills Assessment

Tips On How To Save Money The Easy Way

Saving money seems impossible, especially at entry-level pay. Well, it isn't. Here are some tips on how to save money.

5 Steps to Managing Your Personal Finances Successfully

Managing your personal finances is crucial as a career newbie. Here's how to attain personal financial fitness to be financially independent in the future.

By the way, if you haven't signed up for our FREE ezine, you can do it here...